Initiative's Playbook for Brands to Be вҖҳRecession ReadyвҖҷ in 2023

As the US economy faces the looming threat of a recession, companies are grappling with how to adjust their media buys. Despite the temptation to cut marketing budgets, history shows that brands that maintain or even increase their advertising spend during economic downturns often emerge stronger with a larger market share after the economy recovers.

Marketing budgets are often the first expense that brands cut to save money. But companies can put their market share at risk if they take this course as competitors see opportunity to grab their customers. In planning for a potential recession, brands should question not how much theyвҖҷre spending on advertising, but rather how theyвҖҷre spending their advertising dollars.

Macroeconomic conditions profoundly shape consumer behaviours вҖ“ whether the economy is roaring or faltering. People will always be buying stuff, but how much and what they buy shifts with the economic winds.

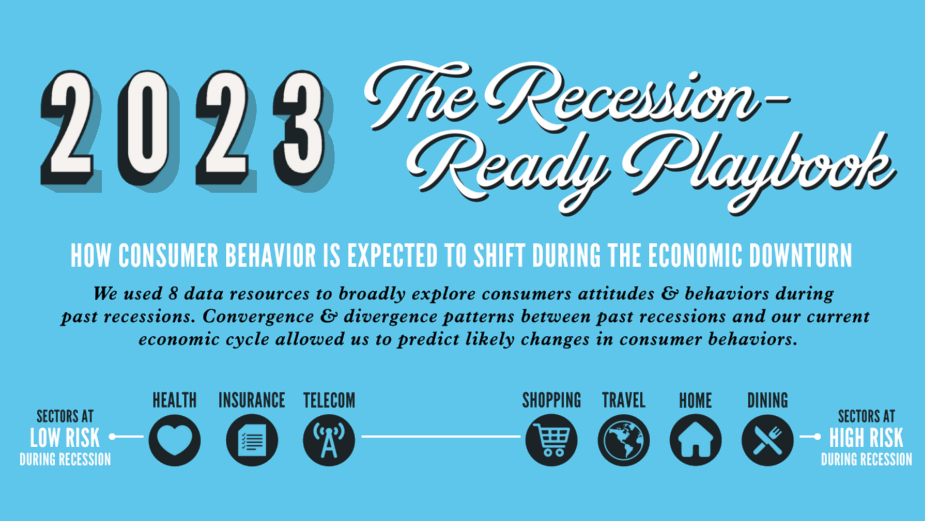

We analysed eight public and propriety data sources about past recessions to arrive at some conclusions about how a 2023 recession might affect consumer behaviours. Recessions pose different levels of risk to various sectors of the economy. Past recessions show us that retail, travel, home, and dining, would be most at risk, while health, insurance, and telecommunications, would be at lowest risk.

The covid economy shaped several new consumer behaviours such as вҖҳcocooningвҖҷ or staying at home for entertainment. This behaviour is likely to re-emerge in the event of a recession but shifting from individual activities to communal ones вҖ“ what weвҖҷre calling the вҖҳOpen House Revival.вҖҷ A consumer behaviour that has already emerged in response to high inflation will continue to grow, what we call вҖҳReframing the Essentials.вҖҷ Consumer will focus on needs rather than wants to cut expenses.

While the job market remains tight, a recession is likely to shift how people work in response to concerns about being laid off. We anticipate there will be a renewed commitment to the workplace as more people shift from virtual to in-person work that will have downstream effects on different consumer behaviours ranging from buying coffee at Starbucks to shopping for new work clothing.

Consumers will look for different ways to cut their spending during a recession. Vacationers will stay with friends and relatives rather than pay for pricey hotels. More people are likely to cut subscriptions to streaming services and dating sites. вҖҳDeal-checkвҖҷ apps will increase in popularity as people look for the best deals on everything from travel to groceries. Big-Box retailers such as Costco and Walmart are likely to see more business as people look for ways to hold onto more of their money. Flexible payment options such as Afterpay and Klarna will also continue to increase in popularity. Finally, more consumers will be looking вҖҳhackвҖҷ their credit cards to accrue points for travel and other discretionary expenses. Check out the infographic below for more of our вҖҳRecession Ready PlaybookвҖҷ insights.

Our advice to companies is to be bold and pivot your ad spend in response to the shift in consumer behaviours that are likely to be affected by a recession. If past is prologue, businesses that lean into this strategy are more likely to retain their market share and even emerge stronger than those that retreat in their advertising spends.

Kareem Bishara is group director for strategy innovation at Initiative. Business Insider named him to their 2022 list of 35 Rising Stars of Madison Ave. list.